In recent years, Australia has faced an escalating cost of living crisis, profoundly impacting the everyday lives of its residents. Factors such as increasing housing prices, rising energy costs, and inflation have all contributed to the financial strain felt by average Australians. Amidst these challenging economic conditions, innovative financial solutions have become essential to help individuals manage their finances more effectively. One such solution making significant strides in addressing these issues is Rease, a peer-to-peer lending marketplace that empowers Australians to make and save money through its user-friendly app.

Understanding the Crisis

The cost of living crisis in Australia is multifaceted, with several contributing factors. Housing prices in major cities have skyrocketed, making homeownership a distant dream for many. Additionally, utility bills, groceries, and transportation costs have seen substantial increases, outpacing wage growth. This imbalance has left many Australians struggling to keep up with their monthly expenses, leading to financial stress and uncertainty.

Rease: A Beacon of Hope

In response to this crisis, Rease has emerged as a beacon of hope for many Australians. By harnessing the power of peer-to-peer lending, Rease connects individuals looking to lend money with those in need of loans, bypassing traditional financial institutions. This model offers several advantages, including lower interest rates for borrowers and higher returns for lenders, compared to conventional savings accounts or investment options.

Empowering Australians

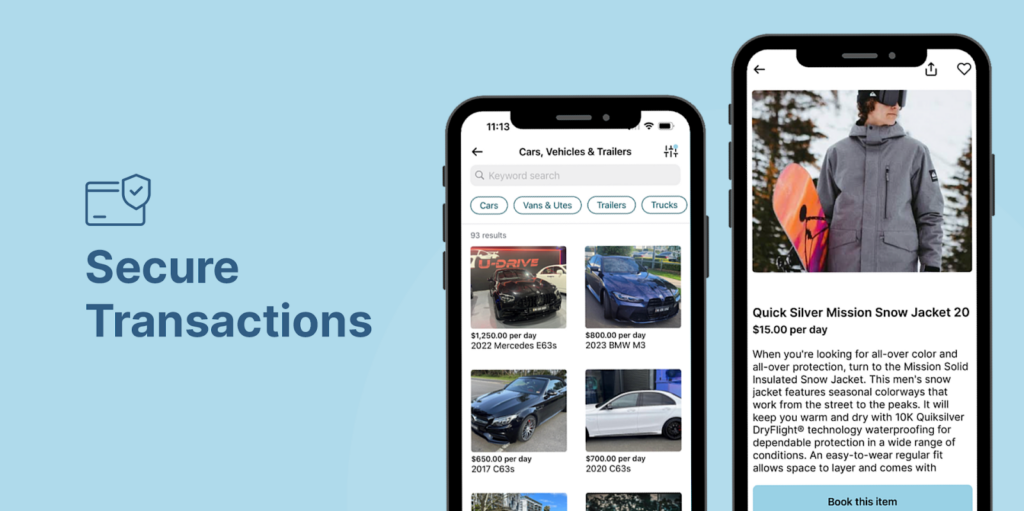

Rease’s platform is designed with the average Australian in mind, offering a straightforward and accessible way to engage in peer-to-peer lending. Whether you’re looking to borrow money to consolidate debt, finance a major purchase, or invest your savings to earn competitive returns, Rease facilitates these transactions with ease and security. The app’s intuitive interface ensures that users can manage their finances on the go, making financial decisions that best suit their needs and circumstances.

Building Financial Resilience

By participating in Rease’s peer-to-peer lending marketplace, Australians can take proactive steps towards building their financial resilience. Borrowers benefit from more favorable loan terms, enabling them to manage their debts more effectively and improve their financial health. On the other hand, lenders have the opportunity to make their money work harder for them, generating income through interest earned on loans. This win-win scenario fosters a sense of community and mutual support, critical values during these challenging times.

Conclusion

The cost of living crisis in Australia requires innovative solutions that address the root causes of financial strain. Rease stands out as a pioneering platform that leverages technology to offer practical financial options for Australians. By facilitating peer-to-peer lending, Rease not only provides an avenue for individuals to manage their finances better but also fosters a sense of community and support. As more Australians discover the benefits of using Rease, it paves the way for a future where financial empowerment and resilience are within everyone’s reach.

Contact:

Website: www.rease.com.au

Email: info@rease.com.au

Address: 22 Garema Cct Kingsgrove Sydney NSW Australia 220